Table of Contents

Ecommerce sales dipped in Q1 compared to the prior quarter, though year-over-year growth remained positive at 3.2%. Rapid tariff changes created uncertainty, prompting consumers to accelerate purchases of big-ticket items (e.g., cars and boats) but cut back on discretionary items like furniture. Meanwhile, ecommerce adoption stagnated due to persistent issues such as high return rates, logistical hurdles for bulky goods, and intense price competition.

- E-commerce sales fell by 20% in Q1 2025, in line with the typical post-holiday slump, though the decline was slightly steeper than anticipated.

- E-commerce penetration held steady at 16.2% of total retail sales (seasonally adjusted), marking the fourth consecutive quarter of stagnation.

- While inventory declines in Q1 were partly seasonal, the anticipation of higher tariffs on big-ticket items—such as cars—prompted consumers to accelerate purchases of motor vehicles and parts, contributing to additional inventory declines in certain retail segments.

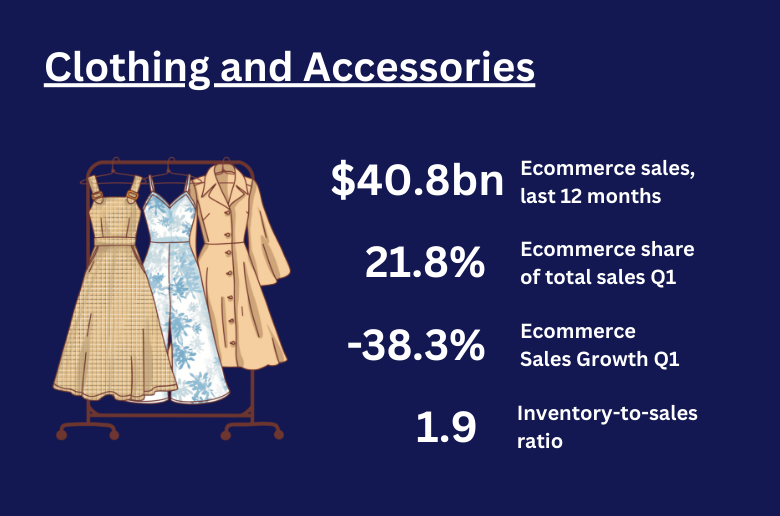

Clothing & Accessories: Tackling High Return Rates

Industry overview

This group includes stores that sell clothing, shoes, jewelry, and accessories. They offer new items for men, women, and children, and include shops like shoe stores, clothing boutiques, and jewelry retailers.

See the full list of industries that fall under ‘Clothing and Clothing Accessories Stores’ (NAICS 448)

- NAICS 448 Clothing and Clothing Accessories Stores

- NAICS 44811 Men’s Clothing Stores

- NAICS 44812 Women’s Clothing Stores

- NAICS 44813 Children’s and Infants’ Clothing Stores

- NAICS 44814 Family Clothing Stores

- NAICS 44815 Clothing Accessories Stores

- NAICS 44819 Other Clothing Stores

- NAICS 44821 Shoe Stores

- NAICS 44831 Jewelry Stores

- NAICS 44832 Luggage and Leather Goods Stores

Industry trends

- Clothing sales dropped 30.0% in Q1 compared to the previous quarter, reflecting the typical post-holiday decline in January and February, with a rebound in March.

- E-commerce clothing sales declined even more sharply, down 38.1% – a steeper fall than anticipated for Q1.

- This pronounced decline may reflect consumers postponing discretionary online apparel purchases amid rising uncertainty.

- According to the University of Michigan, consumer confidence fell 23% from December 2024 to March 2025, driven by concerns about current conditions and future expectations.

E-commerce penetration

- In Q1 2025, 21.8% of all clothing sales occurred online, outpacing the average for all retail sectors.

- Seasonally adjusted e-commerce penetration in clothing has been largely flat over the past four years.

- One likely reason for stagnation is persistently high product return rates, with fashion e-commerce returns often reaching 25–30%.

- Returns are frequently due to fit and style issues, and some consumers intentionally over-order with plans to return, increasing costs for online retailers.

Recent developments

- Nike has moved to restore a full-price model for its Nike Direct business, reducing promotional days and markdowns. This strategy led to reduced traffic and sales in Q3 2025 (ending 2/28/2025), with further declines expected.

- On February 1, 2025, the White House signaled plans to eliminate the de minimis exemption for imports from China under $800 per person. The exemption was officially removed on May 2, impacting low-cost retailers like Temu and Shein.

- On April 4, 2025, the White House granted TikTok a second 75-day extension to sell its US operations or face a ban, with the possibility of further extensions. TikTok Shop has become a major e-commerce player, generating nearly $1.2 billion in Womenswear and Underwear GMV in FY24.

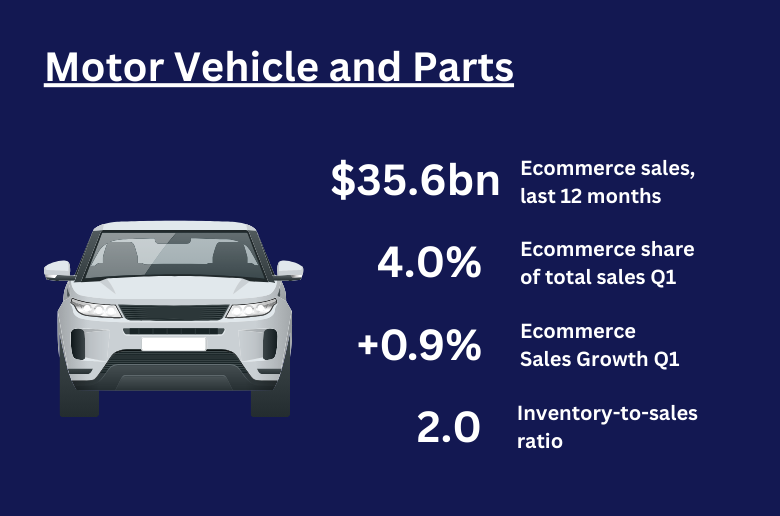

Motor Vehicles & Parts: Navigating New Tariffs

Industry overview

This industry covers dealers who sell new and used cars, as well as RVs, boats, and motorcycles. Businesses in this field also sell tires, automotive parts, and accessories.

See the full list of industries that fall under ‘Vehicle and Parts’ (NAICS 411)

- NAICS 441 Motor Vehicle and Parts

- NAICS 44111 New Car Dealers

- NAICS 44112 Used Car Dealers

- NAICS 44121 Recreational Vehicle Dealers

- NAICS 441222 Boat Dealers

- NAICS 441227 Motorcycle, ATV, and All Other Motor Vehicle Dealers

- NAICS 44133 Automotive Parts and Accessories Retailers

- NAICS 44134 Tire Dealers

Industry trends

- New US tariffs at the end of Q1 triggered a 24% surge in vehicle and parts sales in March, as consumers rushed to buy before price hikes—the largest monthly increase in four years.

- Total motor vehicle and parts sales declined 2.1% in Q1 due to lower January and February sales, primarily for seasonal reasons. However, e-commerce sales rose 0.9%, reflecting the channel’s adaptability, especially amid tariff changes.

- April’s pullback and declining consumer sentiment suggest a more cautious and potentially weaker Q2 2025 for automotive e-commerce.

E-commerce penetration

- E-commerce penetration in this category remains low, at just 4.0% of sales in Q1 2025, due to the complexity of vehicle purchases (inspection, financing, negotiation).

- Nonetheless, penetration has shown steady growth over the past year, driven by fully online models from companies like Tesla, Rivian, and Lucid Motors, and digital growth in auto parts from AutoZone and O’Reilly.

Recent developments

- A Cox Automotive survey in May revealed declining dealer sentiment, with more dealers viewing the market as weak.

- Negative sentiment toward EVs – the main driver of e-commerce sales in this sector – may dampen online vehicle sales, though higher online auto parts sales could offset this.

- In February 2025, eBay acquired Caramel, a US platform for marketplace vehicle sales, expanding its auto sales footprint.

- eBay’s acquisition follows Amazon’s launch of Amazon Auto in December 2024, allowing consumers to browse, order, finance and schedule a pickup of a new Hyundai vehicle from a local dealer directly on Amazon.

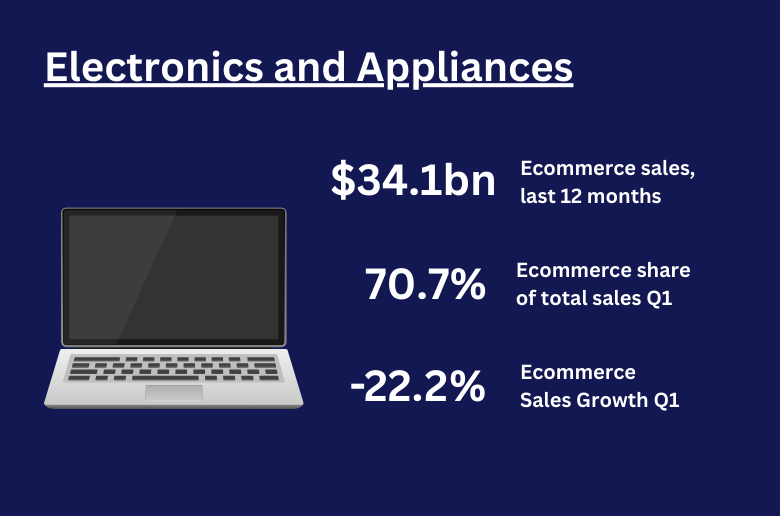

Electronics & Appliances: Capitalizing on Consumer Shift to Online Shopping

Industry overview

Businesses in this industry sell new electronics and appliances—such as TVs, computers, cameras, and household appliances.

See the full list of industries that fall under ‘Electronics and Appliance Stores’ (NAICS 443)

- NAICS 443 Electronics and Appliance Stores

- NAICS 443141 Household Appliance Stores

- NAICS 443142 Electronics Stores

Industry trends

- Electronics sales across all channels dropped 20.5% in Q1 2025, reflecting typical seasonal fluctuations.

- E-commerce sales declined similarly, down 22.2%, as most purchases occurred in December 2024, reducing Q1 demand.

- Overall, sales trends were consistent with historical patterns.

E-commerce penetration

- Electronics and appliances boast the highest e-commerce penetration, with 70.7% of sales online in Q1.

- Penetration has continued to rise over the past three years as consumers increasingly shop digitally.

- Online shopping in this category is favored for its transparency, allowing easy comparison of products, features, and prices.

- Barriers to further e-commerce growth include expectations for fast shipping, easy returns, and competitive pricing.

Recent developments

- On January 16, 2025, BestBuy announced plans to launch a third-party marketplace in summer 2025 via a partnership with Mirakl, reviving a concept discontinued in 2016.

- New US tariffs on Chinese imports could significantly impact electronics retailers, as most US electronics originate from China. While most electronics were exempted from reciprocal tariffs, a 20% tariff remains in effect.

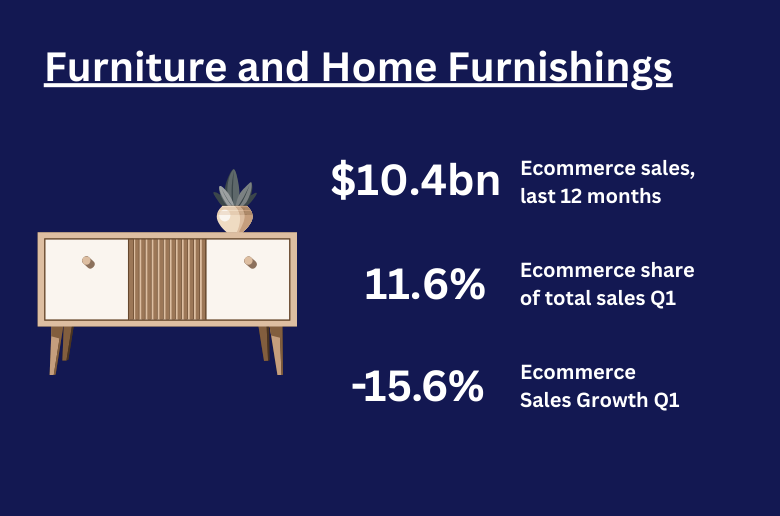

Furniture & Home Furnishings: Setting the Right Expectations to Lower Returns

Industry overview

Businesses in this industry sell new furniture and other products for the home, like sofas, tables and decorations. Brick-and-mortar shops in this industry usually have a shop or showroom where shoppers can see and buy these items. Sometimes, these businesses also help customers choose and arrange furniture for their homes.

See the full list of industries that fall under ‘Furniture and home furnishings’ (NAICS 442)

- NAICS 442 Furniture and Home Furnishings Stores

- NAICS 44211 Furniture Stores

- NAICS 44221 Floor Covering Stores

- NAICS 442291 Window Treatment Stores

- NAICS 442299 All Other Home Furnishings Stores

Industry trends

- Sales of furniture across all sales channels declined 9.9% in Q1, which is consistent with seasonal post-holiday declines.

- E-commerce sales declined 15.6%, a slightly sharper drop than the 12.5% Q1 decline reported by Wayfair.

- E-commerce furniture sales are historically more volatile than brick-and-mortar, with sharper swings due to the ease of making impulse purchases online during peak periods and pullbacks in slower times.

E-commerce penetration

- E-commerce penetration dropped to 11.6% of furniture sales in Q1, the lowest since Q2 2022.

- This decline was stronger than usual for Q1, reflecting ongoing challenges.

- The overall e-commerce trend for furniture has been slightly negative in recent years, likely due to consumer sentiment and logistical hurdles.

- While digital confidence is growing—thanks to 3D visualization and AR—many consumers still prefer to physically inspect large items before buying.

- Furniture’s bulk and shipping costs, along with risks of damage and expensive returns, remain significant barriers to e-commerce adoption.

Recent developments

- In March 2025, Wayfair launched Wayfair Verified, a quality assurance program that assigns a seal of approval to products passing a rigorous expert evaluation, aiming to reduce returns and enhance customer experience.

- In May 2025, Lowe’s announced a partnership with Mirakl to expand its home segment assortment, leveraging Mirakl’s tools for catalog, order, and seller management.

- In February 2025, Wayfair introduced Muse, a generative AI tool allowing shoppers to generate inspirational room images based on prompts, with links to actual Wayfair products.

Sporting Goods, Hobbies & Books: Adapting to E-commerce and Consumer Shifts

Industry overview

This group includes businesses that sell sporting equipment (e.g., bicycles, camping equipment), hobby and craft supplies (e.g., pottery, toy stores), musical instruments (e.g., piano, sheet music), and books.

See the full list of industries that fall under ‘Sporting Goods, Hobby, Musical Instrument, and Book Stores’ (NAICS 451)

- NAICS 451 Sporting Goods, Hobby, Musical Instrument, and Book Stores

- NAICS 45111 Sporting Goods Stores

- NAICS 45112 Hobby, Toy, and Game Stores

- NAICS 45113 Sewing, Needlework, and Piece Goods Stores

- NAICS 45114 Musical Instrument and Supplies Stores

- NAICS 451211 Book Stores

- NAICS 451212 News Dealers and Newsstands

Industry trends

- Retail sales in this segment declined slightly more than expected in Q1, following stronger-than-usual holiday sales in Q4.

- E-commerce sales saw a sharper drop of 31.3%, compared to a 26.5% decline across all channels, likely due to reduced discretionary spending amid economic uncertainty.

- According to University of Michigan, consumer confidence dropped 23% between December 2024 and March 2025, driven by both declining sentiments for the current economic conditions as well as deteriorating expectations for the next 12 months.

E-commerce penetration

- E-commerce penetration in this segment stands at 15.4%, on par with the broader retail sector.

- Seasonally adjusted penetration has continued to rise over the past two years, reflecting growing digital adoption.

- Book sellers enjoy high e-commerce penetration, but musical instrument sales online face challenges due to product fit and quality concerns, which are difficult to assess remotely.

- The bulky and fragile nature of some musical instruments and sporting goods (e.g., bicycles, bowling equipment) also limits full e-commerce adoption.

Recent developments

- In May 2025, Guitar Center appointed Erick Smith as Director of E-commerce, leveraging his 15+ years of retail technology expertise to advance digital strategy.

- Barnes & Noble, despite the digital shift, plans to open over 60 new physical stores in 2025, many of which will be smaller and community-focused.

- In January 2025, eBay partnered with OpenAI to introduce Operator, a smart virtual assistant that helps shoppers find products and guides them to eBay, streamlining the search for unique items.